Landlord Insurance

LANDLORDS INSURANCE

LANDLORD INSURANCE SPECIALISTS

You may become a property investor or developer to help yourself get ahead and perhaps build a nest egg for your future or retirement. For the most part, investment property ownership can be a rewarding experience, but it’s not always the case. Reliable tenants and a secure investment aren’t a given.

As a landlord, you need insurance to reduce the risk of damages or loss associated with your property.

Landlord insurance provides the protection you need to cover your property, asset, rental income and legal liabilities.

It is a specialist policy that provides considerably more coverage than normal home insurance. It is important to note that a standard home insurance policy would be invalid if your property is let to tenants. It’s just not worth the risk.

(1) Standard policy - provides cover for loss of rent, contents, and liability

(2) Combined Policy – provides cover for the building replacement as well as loss of rent, contents, and liability

For properties under a Strata Complex, unit or flat, the insurance for the building is looked after by the owner’s corporation, so there is no requirement to include insurance on the building as part of your landlord policy.

But if the property is a standalone house or duplex, building replacement cover is essential, and the Combined Landlord policy is required.

- Accidental damage – if your tenant damages your property unintentionally. Most typical landlord insurance products on the market advise they include accidental damage cover, they limit this to Tenant Damage only. This means that only damage directly caused by a tenant is covered. Under the Cover Guard Landlord policy - we have the only policy which provide Full Accidental Damage Cover. Where cover is provided irrespective of if the damage is directly caused by the tenant or not. Giving you peace of mind to know you’re covered.

- Malicious damage – if your tenants intentionally damage your property.

- Property owner’s liability – if you are deemed liable for damage or injury suffered by third parties arising from your ownership of the property.

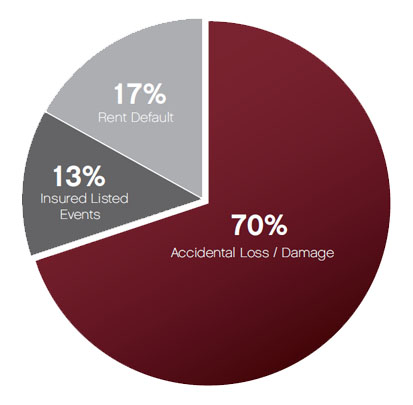

- Rent Default – Where your tenant vacates and breaks their lease agreement without notice resulting in loss of rent.

- Loss of rent – Loss of rent following property damage, and where the property is uninhabitable due to this damage. Cover is also provided for loss of rent when the tenant is unable to access the property due to insured property damage.

- Tenant refusal to Vacate - Tenant Refusal to Vacate – your tenant stops paying rent and refuses to vacate. The policy also provides cover for legal costs.

|

|

Protection of rental income due to (but not limited to):

- Rent Default

- Absconding Tenant

- Tenant failure to vacate premises

- Death of Tenant

- Tenant Hardship

- Property unable to be leased following damage

- Prevention of access

- Associated legal fees

Protection for the property contents (owned by the Landlord) including but no limited to items such as, fixtures and fittings, appliances, blinds, carpets, floor coverings, fittings, portable pools, spas, household furniture, furnishings and light fittings, where loss or damage occurs due to (but not limited to) :

- Tenant Damage

- Malicious Damage

- Full Accidental Damage

- Flood

- Perils (Fire, Storm, wind, earthquakes, etc...)

- Escape of Liquid

- Burst Pipes

- Theft, Break in or vandalism

- Scorching or burning

- Impact

- Glass Breakage

- Electronic Motor Burnout or fusion

- Lightning

- Power Surge

Contact our trusted team today

Cover for legal liability following third party injury or third party property damage. Up to $20 million cover each claim.